Cannot provide advice on cryptocurrency trading. However, they can provide some general information that could be helpful.

What is the systemic crypto risk?

Crypto systemic risk refers to the potential of a significant and widespread disturbance of financial markets due to failures in the functioning or stability of certain components. This includes banks, payment processors, exchanges, custody and other companies that support the crypto market. When there is a systemic risk, it can lead to a cascade effect: losses at some point may have large consequences for others.

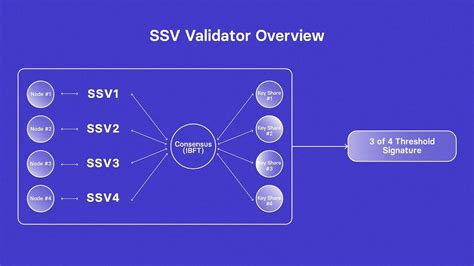

Validator nodes

The validator nodes are crucial in maintaining the integrity and stability of blockchain networks. They provide the security of transactions by checking the validity of the data before being added to the chain. Here are some key roles:

–

Self -decentralized autonomous organizations (DAO): Daos use the validator’s nodes as a basic component for the decision -making processes in their network.

–

Consensis mechanisms: Validator nodes help in consensus mechanisms such as Saturday (POS) and work proof (POW), ensuring that blockchain works in a predictable and safe way.

–

The network segmentation: they often act as porters or segments in networks, segregating different types of data or transactions to prevent potential security violations.

Buy Crypto

When you consider buying cryptocurrency, it is essential to understand your motivations, risk tolerance and investment goals. Here are some points to think:

- Research : Research in detail cryptocurrency that you are interested in. Look at its technology stack, market trends, financial (if available), team, community support and potential cases.

- Do you understand market risks

: cryptocurrency markets can be extremely volatile due to factors such as supply and demand imbalance, regulatory changes and global economic conditions.

- Diversification : Spread -Investments in a number of assets to minimize the risk. This could include other cryptocurrencies, traditional stocks or bonds or even Fiat coins.

- Educate -va : Learn about the crypto market and its mechanics. Understand the different types of available wallets (for example, hardware, software) and how it differs in security and ability to use.

- Looking for professional tips : If you are new in investments in cryptocurrency, consider consulting with a financial advisor or making your own analysis before making investment decisions.

Conclusion

The investment in cryptocurrency should be approached with thought, taking into account both the potential benefits (if they behave well) and the risks (if not). A diversified approach, thorough research and awareness of market fluctuations are essential for making knowledge.